A key litmus test for the state of the economy is the number of days it takes for businesses to pay overdue bills.

illion’s Trade Late Payments Report is the most comprehensive in the market. Our latest report for the 2020 December quarter shows the Australian economy has some way to go before businesses can rest easy and conclude the (economic) worst is behind us.

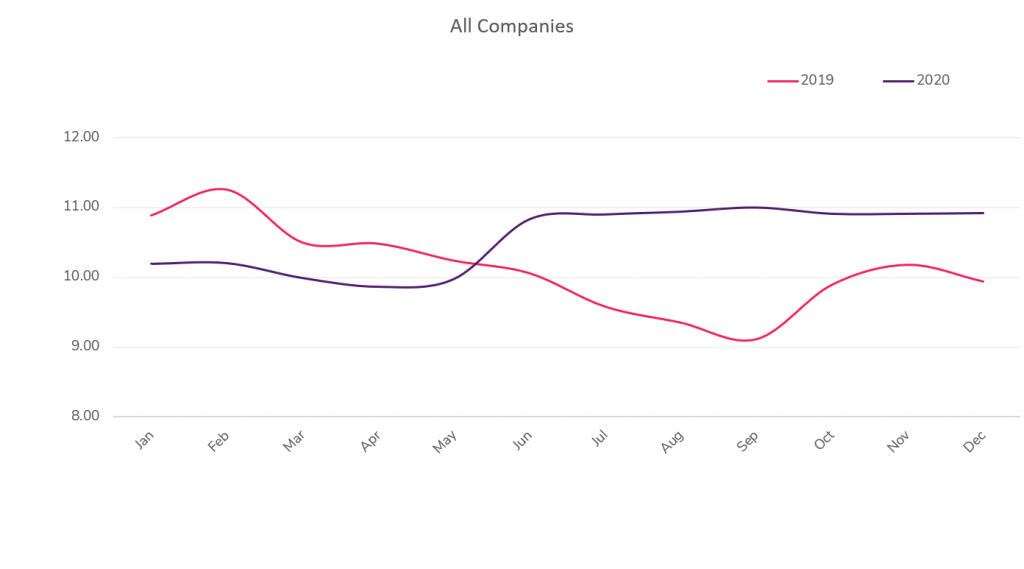

Although the number of days it took for businesses to pay outstanding bills improved – down 0.7% since the September 2020 quarter — they are still 10% worse than pre-COVID-19 levels.

The December quarter development can be attributed to pandemic lockdowns easing. But whether businesses will recover entirely in 2021 – particularly as government economic initiatives such as JobKeeper are withdrawn – remains uncertain.

Caption: Late payment times: 2019 vs 2020

Given the Report is based on the largest database of business-to-business payment information in Australia and New Zealand, we’ve also analysed what difference the size of your business and industry segment can make to when you will get paid.

David Vs Goliath

In recent years, plenty of calls have been made to big business to pay their smaller suppliers more quickly. And it looks like it is paying off.

Analysing late payments across different sized businesses, the shoe is now firmly on the other foot as larger businesses are now receiving payment later than smaller businesses.

Larger companies are now less likely to pay each other on time, with late payment times between big businesses averaging 15.5 days in December 2020, compared with only 13.9 days during the same time last year.

In contrast, late payments from big companies to small businesses averaged only 13.4 days.

It’s encouraging news for Australia’s 2 million plus SME businesses but a stark warning for larger companies. Big business will need to have tight reigns over their receivables this year, especially as much of the government support comes to an end.

Construction industry moves at different pace

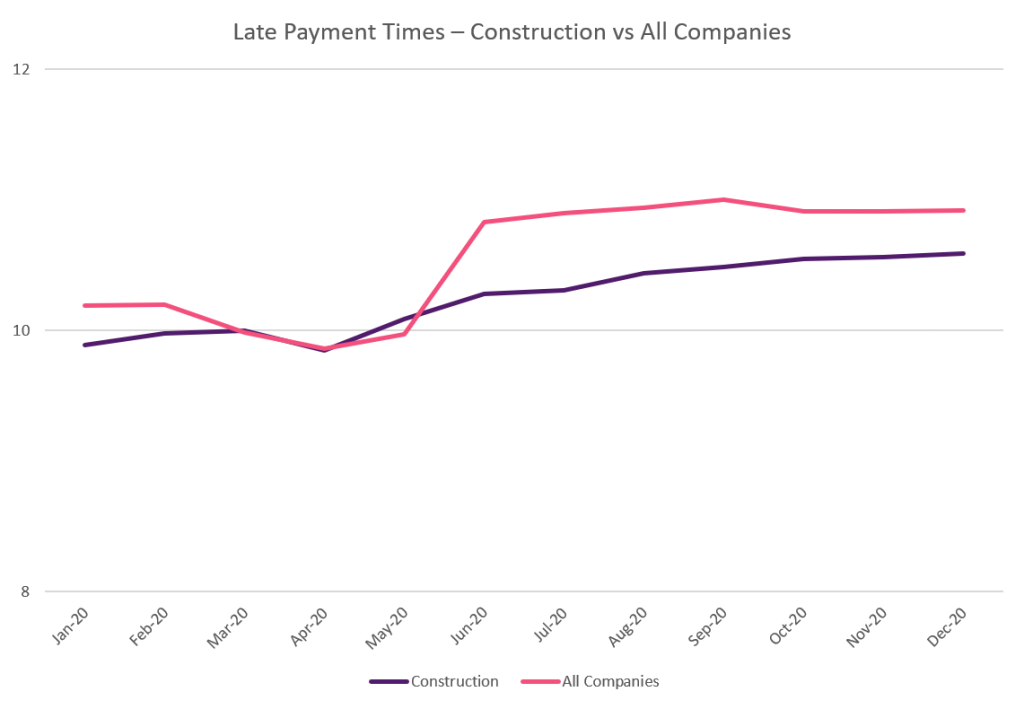

Manufacturing, wholesale and retail businesses were more inclined to pay their bills in a timely fashion during the last quarter, particularly compared to winter months.

In addition, spending picked up in other areas – particularly on home-based products and services[1] – offering businesses across the consumer supply chain some buffer from the pandemic.

However, construction companies saw their payments steadily worsen between April and December, albeit at a slower rate. This may be due to the long lead times in the sector, with businesses sometimes taking months to feel the full impact of economic disruptions.

The economic environment in Australia will likely paint some more mixed messages this year — and we could see more businesses fail to pay their bills on time, or fail to pay them entirely.

Companies will need to understand their debtors’ risk to minimise this impact. To learn more about how your business can participate in and benefit from illion’s trade data program, get in touch with us.

Want to learn more?

Fill in this form to talk to our friendly team today.