illion’s geographical profiling capabilities can open up brand-new areas of opportunity.

By leveraging our expansive bureau information, we can aggregate geographical areas down to mesh block levels (30 to 60 households) to reveal extensively detailed insights.

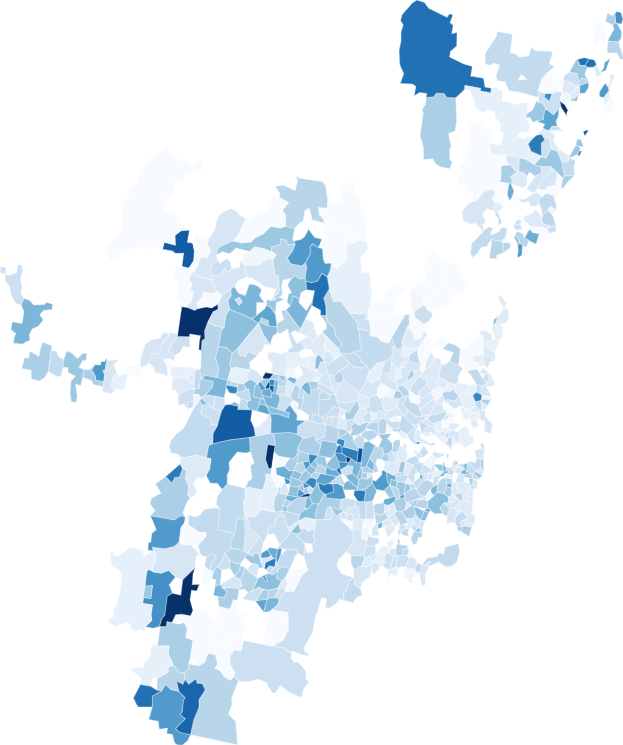

Where Sydney homeowners are behind on their mortgage repayments

% of home loans that are 30+ days past due

Current % 0.1 2.5

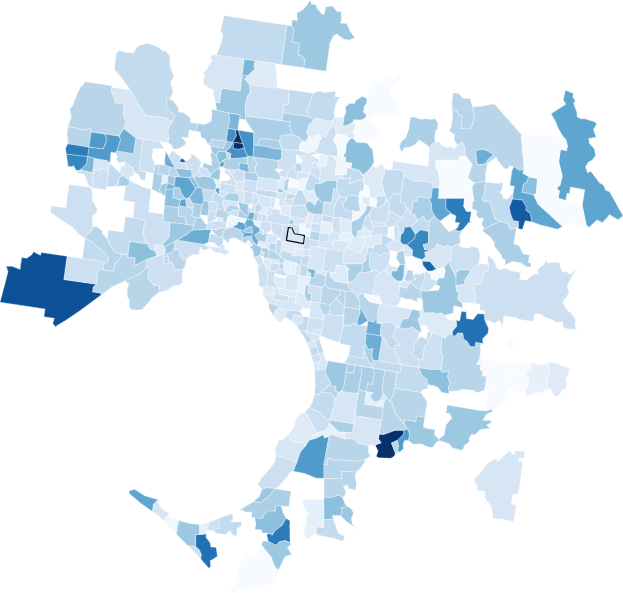

Where Melbourne homeowners are behind on their mortgage repayments

% of home loans that are 30+ days past due

Current % 0.1 2.5

With just a customer address, we can uncover a rich profile of the location’s demand, spend, income, credit risk and collections history.

Tap into a range of unique and powerful insights

Geographic Risk Index (GRI)

GRI indicates how likely a consumer is to default relative to the Australian population. illion’s GRI measures the concentration of risk based on all available forms of credit. It then assigns a 0 (Worst) to 100 (Best) rating to each location based on the incidence of credit risk behaviour within an area.

Geographic Transaction Score (Geo iTRS)

By using transaction data to provide a transactional score up to a mesh block level, Geo iTRS provides insights on consumer behaviour not available elsewhere in the market.

Geo iTRS unlocks hidden growth opportunities overlooked by traditional processes, such as the rise of incomes dependent on the gig economy and the uptake of Buy Now Pay Later options.

When combined with GRI, Geo iTRS delivers a significant performance uplift, offering the most predictive and powerful solution for optimal credit risk segmentation and targeting.

Geo Centrelink

Geo Centrelink uses illion’s unique data sources to aggregate and rank all forms of Centrelink customer income data across a geographic area, relative to the Australian Population. Along with other GRI data, it can be used to identify areas of financial hardship.

Credit Demand Index (CDI)

CDI is a geographic propensity index that indicates the likely number of credit enquiries over the next quarter for different credit types. The values indicate how likely an individual is to make a credit enquiry over the next 3 months relative to the consumer average.

CDI is built using multiple data sources, counting all the enquiries with regression modelling at a mesh block level. The CDI index ranges from 1-7, with 1 representing low credit demand and 7 representing high credit demand.

Geo Attributes applications

Geo Attributes can be used for a vast range of business purposes. Many different organisations including financial services, telcos, fast-moving consumer goods services, utilities, government departments and digital platforms use illion Geo Attributes.

Geo Attributes can help you:

- Develop an acquisition strategy

By identifying potential leads and prospects with a higher propensity to buy new products, you can effectively identify potential growth areas, qualify prospective leads and significantly improve return on investment. - Identify gaps in existing sales and marketing strategies

Geo Attributes can help you improve your sales and marketing strategy or planning by pinpointing specific customer groups with a desired level of credit risk, enabling better targeting of customers and local area marketing. - Improve location planning

When deciding on where to set up points of sale, branches, sales people and events, Geo Attributes can help you choose the most appropriate geographic location. - Validate customer segmentation

Geo Attributes enables both portfolio and market segmentation. By optimising market analysis to determine customer divisions, you can make effective business decisions. - Authorise sales blocked by no credit file

Want to target Generation Z? Geo Attributes can provide a powerful indication of risk for potential customers who are new-to-bureau or have limited credit history, expanding the market opportunities available to you. - Determine pricing and risk

Pricing, risk and actuarial teams can use this score to augment with other key sources of data to price risk and create an effective and profitable pricing strategy. - Facilitate a retention strategy

Geo Attributes enables you to identify customers at risk of attrition and churn, and formulate appropriate strategies to retain them, so you can maintain and enhance your portfolio. - Optimise debt recovery

Do you need a more effective and efficient debt recovery process? Apply scores to a book of debtors to indicate the likelihood of recovering money owed and take action accordingly, so you can improve your business cash flow.

Want to learn more?

Fill in this form to talk to our friendly team today.