We have recently announced that Optus is the first company to provide partial CCR account data to credit bureaus.

As partial CCR data does not include a customer’s repayment history, its important credit providers understand how to interpret the data.

In light of this, we would like to explain exactly what this data represents and how it can benefit both credit providers and customers.

Firstly, it is important to note that partial CCR account data has no impact on a consumer’s credit score.

What is CCR?

In 2014, the Australian Government amended the Privacy Act 1988 to introduce Comprehensive Credit Reporting (CCR). This legislation change meant positive, as well as negative data, could be included on credit reports and used by credit providers to assess credit risk.

Prior to this, legislation governing consumer credit reporting permitted only negative items to be disclosed, including information such as credit enquiries, credit payment defaults and other adverse information.

Three tiers of consumer bureau credit information

Consumer bureau credit data is structured into three tiers:

- Negative – which includes credit enquiries, defaults, bankruptcies, judgements etc.

- Partial – which includes negative, plus Consumer Credit Liability Information (CCLI).

- Comprehensive – which includes negative, partial, plus Repayment History Information (RHI).

What partial CCR data does not include

It is important to note that partial CCR data does not include RHI.

With partial CCR, the absence of repayment history is not an indication of a failure to make repayments.

Repayment information is only shown with comprehensive CCR, where a record of repayment against the account is provided for a period of up to two years, showing evidence of how the individual pays their bills.

Again, partial CCR does not show this repayment information.

Why use CCR data?

CCR data is beneficial to credit decisioning as it provides a much more complete picture of an individuals credit behaviour.

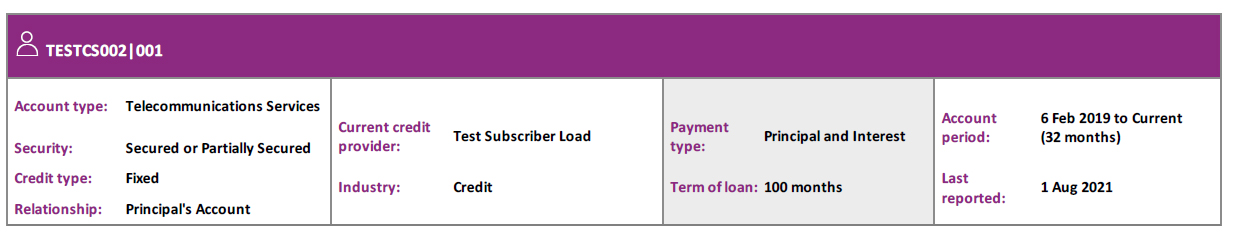

While negative data provides information about credit enquiries and adverse information the Optus partial CCR data includes the credit provider, account type, account number, date opened, relationship, current credit limit and date closed for over 5 million accounts.

What will this look like?

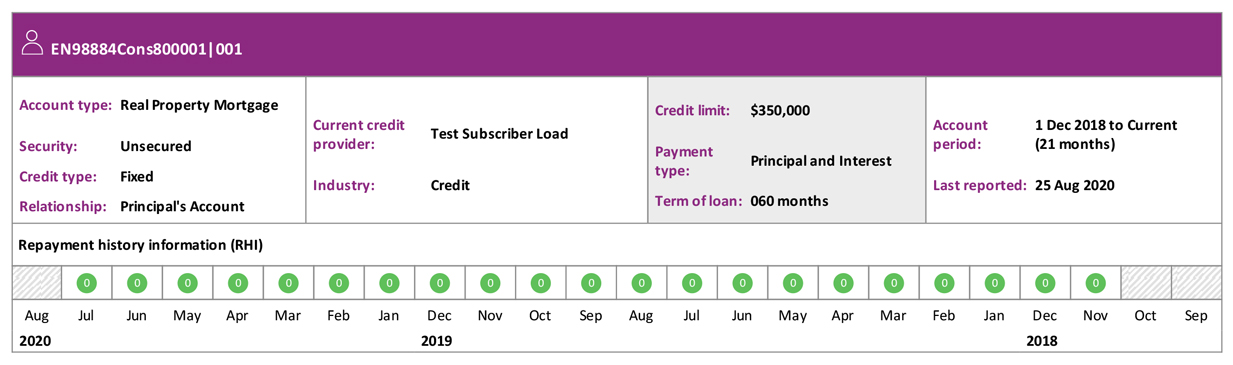

Comprehensive CCR data appears on illion reports as follows. The information presented includes the account information followed by the repayment history.

Partial CCR data contains the account information but no repayment information is provided as per the following. The absence of repayment information does not indicate that the individual is not making repayments.

To find out more about accessing illion CCR data, contact Richard Atkinson at richard.atkinson@illion.com.au.

Want to learn more?

Fill in this form to talk to our friendly team today.