Western Sydney the canary in the coal mine for commercial insolvencies and economic recession in 2023. Victoria’s Hume and Wyndham not for behind. Perth doing best.

11 April 2023: Businesses across the country are starting to feel the squeeze as consumer financial strain trickles down into business performance.

Credit bureau illion has released new data on the geographic areas of Australia that have the highest risk of business failure in 2023.

- Sydney’s Western and South-western suburbs are in the unfortunate position of having the highest probability of business failure in the whole of Australia.

- In Melbourne, Wyndham in Melbourne’s West has the highest risk of business failure, followed by Hume and Brimbank (North-west).

- Up in Queensland the region around Inala, Richlands, and Durack have the highest risk of business failure, twice as high as Brisbane CBD.

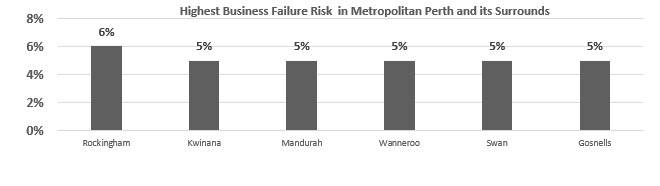

- In Perth, the outlying southern regions of Rockingham, Kwinana and Mandurah have the highest risk of business failure.

- In South Australia, Playford has twice the business failure risk of metropolitan Adelaide.

National

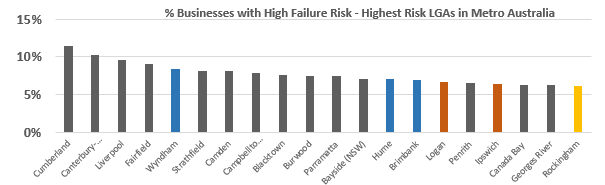

Local Government Areas in a geographic arc from Blacktown, in Sydney’s west, to Campbelltown, in the South-west, have the highest national risk of business failure over the next 12 months, as compared to all other LGAs in Australia.

In particular, 11 per cent of businesses in Cumberland were found to have a high risk of business failure over the next 12 months, with Canterbury-Bankstown and Liverpool close behind with 10 per cent, and Fairfield, in excess of nine per cent. All four LGAs had more than double the percentage of businesses that were at high risk of business failure when compared to the national average of 4.6 per cent.

Western and South-western Sydney accounted for 10 of the 11 riskiest LGAs in Metropolitan Australia, with only Wyndham, in outer western Melbourne, having a similar level of business failure risk.

Across all national metropolitan areas, the top 20 riskiest municipalities in order can be seen in the below graph.

“The whole of Australia should be watching and reading about Western Sydney very closely. Although they are further down the path, our data shows that the risk of business failure is increasing in all capital cities,” said illion’s head of modelling, Barrett Hasseldine.

“Western Sydney has unfortunately become the national canary in the coal mine, and the canary has started to go quiet.”

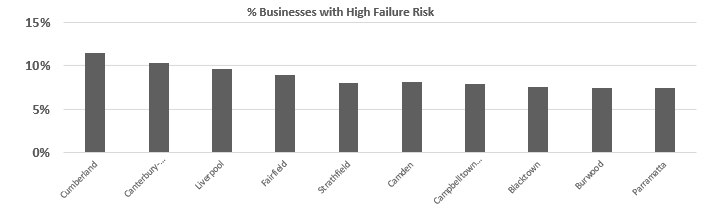

NSW

NSW has 10 of the 11 riskiest LGAs in metropolitan Australia.

Business failure risks in these regions have been trending upward by an average 40 basis points over the two months to January 2023. Across each of these NSW LGAs, the four highest at risk industries were consistently shown to be construction, transport, retail services, and food services. illion observed that more than 15 per cent of construction, transport/warehousing and food services businesses, and more than 10 per cent of retail businesses had a high risk of failure in the next 12 months. These industries were generally twice as risky as professional services, manufacturing, healthcare, and wholesale trade.

Immature businesses in each of these industry sectors had an even higher risk of failure, with a huge 50 per cent of construction businesses, 30 per cent of retail businesses and 33 per cent of food services businesses at high risk of failing in 2023, if they had been in operation for less than two years.

“It’s possible that we’re now starting to see the consequence for business activity from the belt-tightening employed by consumers over 2022 and into 2023, said Mr Hasseldine. “This is on top of the supply chain constraints that hit businesses over 2022.

“This fall in disposable income may be adversely affecting businesses, in terms of new building approvals and home renovations as well as on retail trade, travel, and dining out.

“Risk of business insolvencies needs to be very closely monitored in these four industry segments, and organisations who do business with these four industry segments must pro-actively monitor their business relationships to reduce the possibility of contagion into the broader economy.”

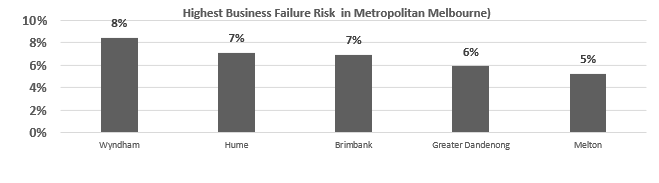

VIC

In Melbourne, Wyndham (including Werribee and Hoppers Crossing) has the largest percentage of businesses with a high risk of failure into 2023 at eight per cent, followed by Hume (also covering Broadmeadows) with seven per cent, and Brimbank in Melbourne’s north-west also with seven per cent.

Each of these regions showed a business trading risk substantially higher than the Melbourne CBD average of four per cent.

The Greater Dandenong region was the fourth riskiest LGA in Melbourne, with six per cent of its businesses having a high risk of failure into 2023. Like in NSW, industries with a particularly high risk of business failure in these metropolitan regions were ‘construction’ at nine per cent at risk, and ‘food services’ with 11 per cent at risk of insolvency.

Immature businesses in each of these industry sectors had an even higher risk of failure, with around 35 per cent of construction businesses and 30 per cent of food services businesses at high risk of failing in 2023 if they had been in operation less than two years.

“These findings in Melbourne demonstrate the potential risk of contagion to the broader economy from the economic stress being felt by consumers in the city fringe,” said Mr Hasseldine.

“What we’re seeing in Melbourne is broadly consistent with the fringe suburbs of all major Australian capitals. Ultimately, the financial strain experienced by Australians since 2022 may soon have an impact on business conditions.

“Consumers tightening their belts is happening in regions where they have a lower capacity to weather economic shocks and so businesses operating in these areas may be the most vulnerable.”

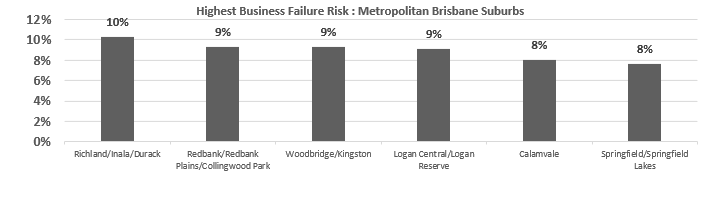

QLD

Areas most at risk of business failure around Brisbane are in the region around Inala, Richlands, and Durack. They have more than 10 per cent of businesses at risk. This is closely followed by Redbank, Redbank Plains, Collingwood Park, Woodbridge, Kingston, Waterford, Logan Reserve and Logan Central with over nine per cent at high risk of failure. Each of these regions has a business failure risk at more than twice the risk in the Brisbane CBD average of four per cent.

In each of these higher risk regions of metropolitan Brisbane, food service businesses have a particularly high risk of business failure. This ranges from 11 per cent of businesses in Logan Central/Logan Reserve to a huge 24 per cent of businesses in Inala and Richlands.

Immature businesses in the food services industry had an even higher risk of failure, with Springfield sadly having the highest business failure risk amongst newly opened businesses at nearly a third – 32 per cent.

“These findings demonstrate the potential risk of contagion to the broader economy from the economic stress being felt by low to middle income consumers in the suburban fringe, he said. “What we’re seeing in the Brisbane area is broadly consistent with the fringe suburbs of all major Australian capitals. Ultimately, the financial strain being experienced by Australians since 2022 may soon have an impact on business conditions – especially in terms of discretionary spend, such as dining out, takeaways, café lunches, and morning lattes.

“The belt-tightening is happening in regions where consumers have lower capacity to weather economic shocks and so, businesses operating in these regions may ultimately be the most vulnerable as we move through 2023.”

WA

In Perth the areas of Rockingham (six per cent), Kwinana and Mandurah (five per cent), Wanneroo (five per cent), Swan (five per cent) Gosnells (five per cent) are showing the highest business failure risk. However, on a national scale, this is significantly lower than other states. Perth is faring the best out of all the capital cities that illion collected data on.

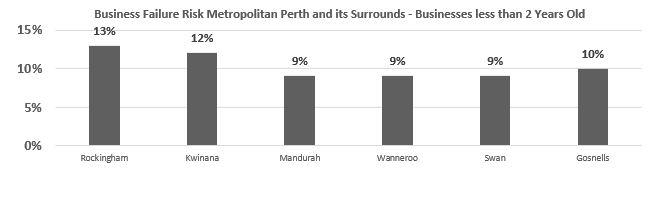

Unlike other Australian capital cities, no industry has a materially higher risk, however recently opened businesses less than two years old have a significantly higher risk of failure. The risk in Rockingham rises from six per cent to 13 per cent for recently opened businesses and in Kwinana from five per cent to 12 per cent.

Mr Hasseldine commented: “Young businesses in the far southern reaches of Perth, into Rockingham and the neighbouring Kwinana, both have around four times higher failure risk of businesses in the Perth CBD. In the LGAs of Mandurah, Wanneroo, Swan, and Gosnells, this risk is three times higher.”

“What we’re seeing in Perth is broadly consistent with the fringe suburbs of all major Australian capital, however Perth is faring better than others. Like others though, the financial strain being experienced by Australians since 2022 may soon have an impact on business conditions. Perth should be watching what is happening in Western Sydney very closely as they could be not far behind.”

Mr Hasseldine said as the volume of failing companies started to rise, this would directly affect employees’ household incomes and elevate their levels of financial stress.

“The effects of these household cashflow pressures may not be visible on a consumer credit bureau for several months while the affected household adjusts their budget and leverages any financial buffers available to them.

“As such, an increasing number of lenders are turning to the analysis of an individual’s banking transaction data to identify signs of financial stress before they start missing loan repayments which get reported to the bureau”.

Want to learn more?

Fill in this form to talk to our friendly team today.