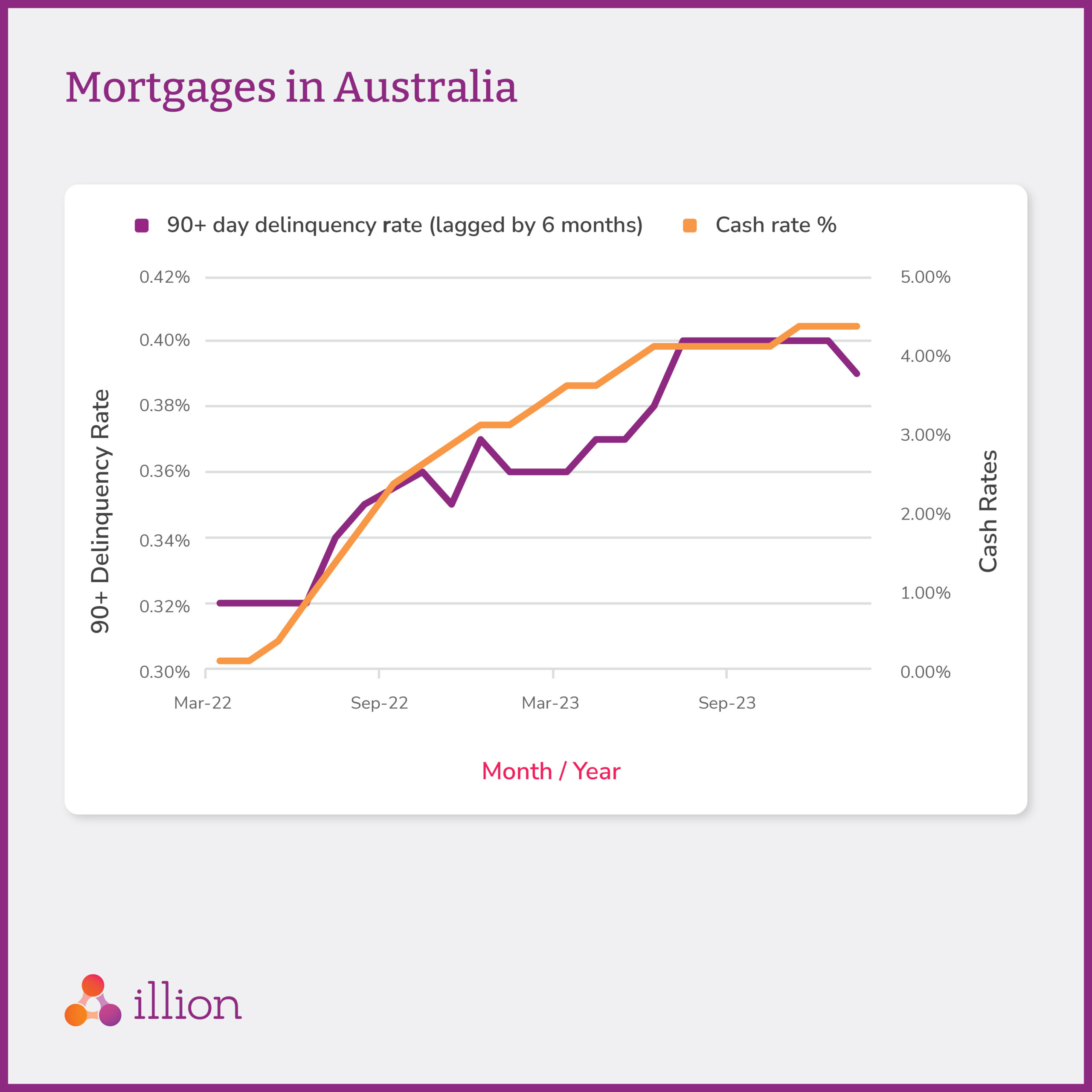

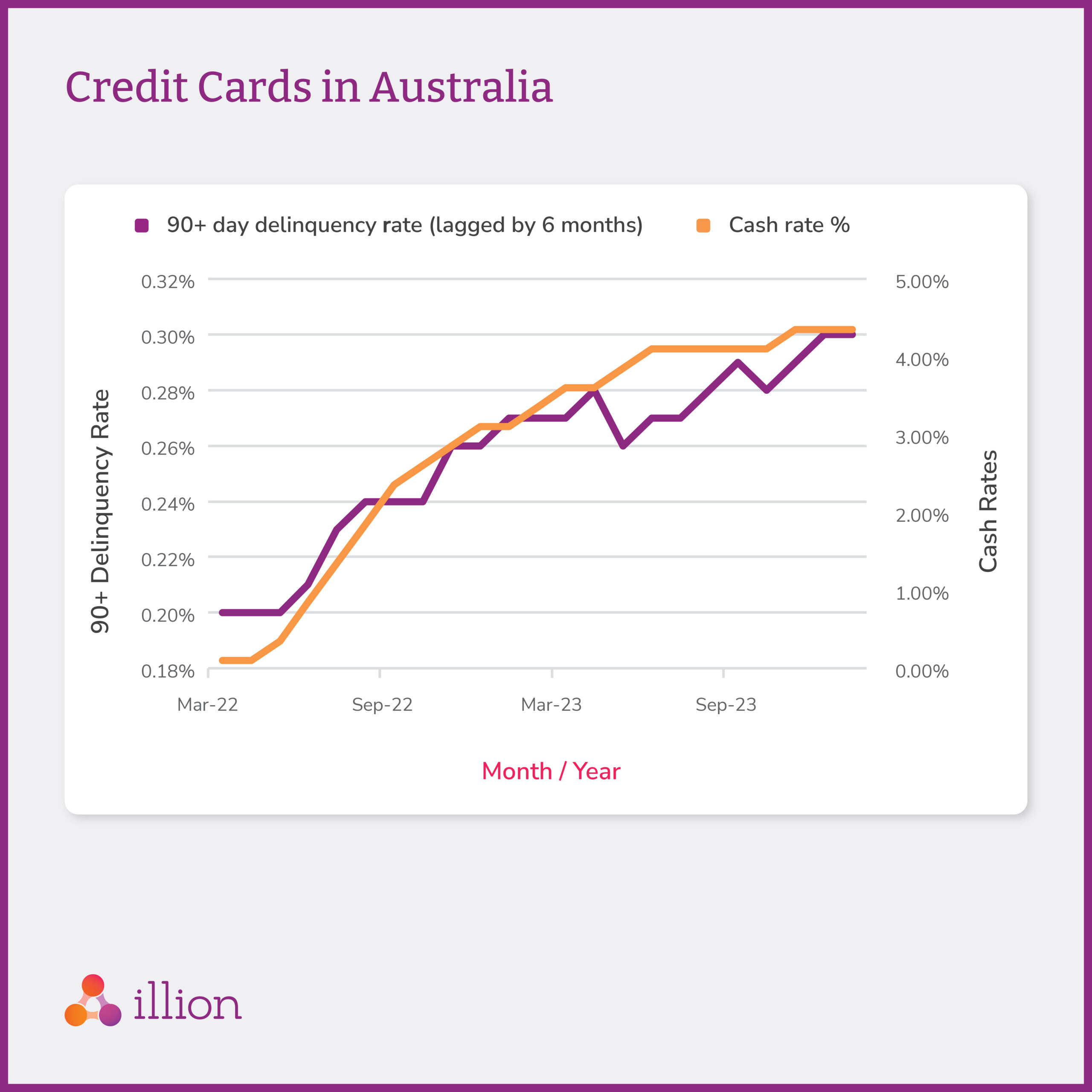

Our latest Australian Economic Snapshot details a significant link between sustained high cash rates and rising consumer delinquencies.

Discover our data collection and analysis methods in the blog below.

Behind the Data: The who, what, where, when and why behind the data

Who: The analysis is compiled by illion Head of Analytics Louis Tsang and illion Analytics & Insights Analyst Saaransh Mehta

What: The analysis and data is sourced from illion’s consumer bureau. The report examines repayment history information from the comprehensive credit reporting data and RBA cash rate movements.

Where: This analysis covers Australia. illion has one of the largest and most comprehensive commercial bureaux in Australia and New Zealand.

When: Since May 2022, delinquencies have been steadily increasing across all consumer lending products.

Why: Monitoring consumer repayment risk proactively is vital to managing risk and helping consumers address hardship and financial distress.

Want to learn more?

Fill in this form to talk to our friendly team today.