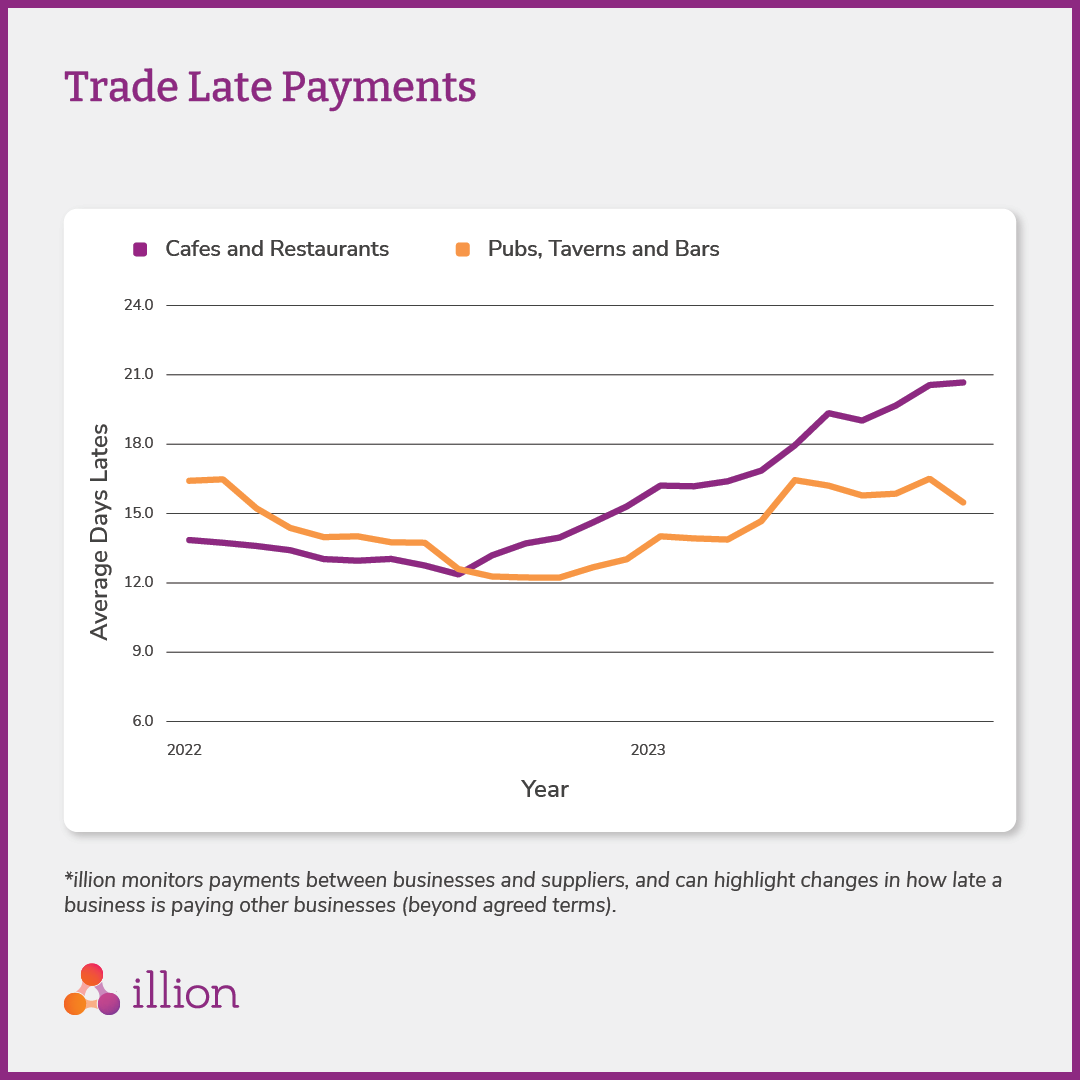

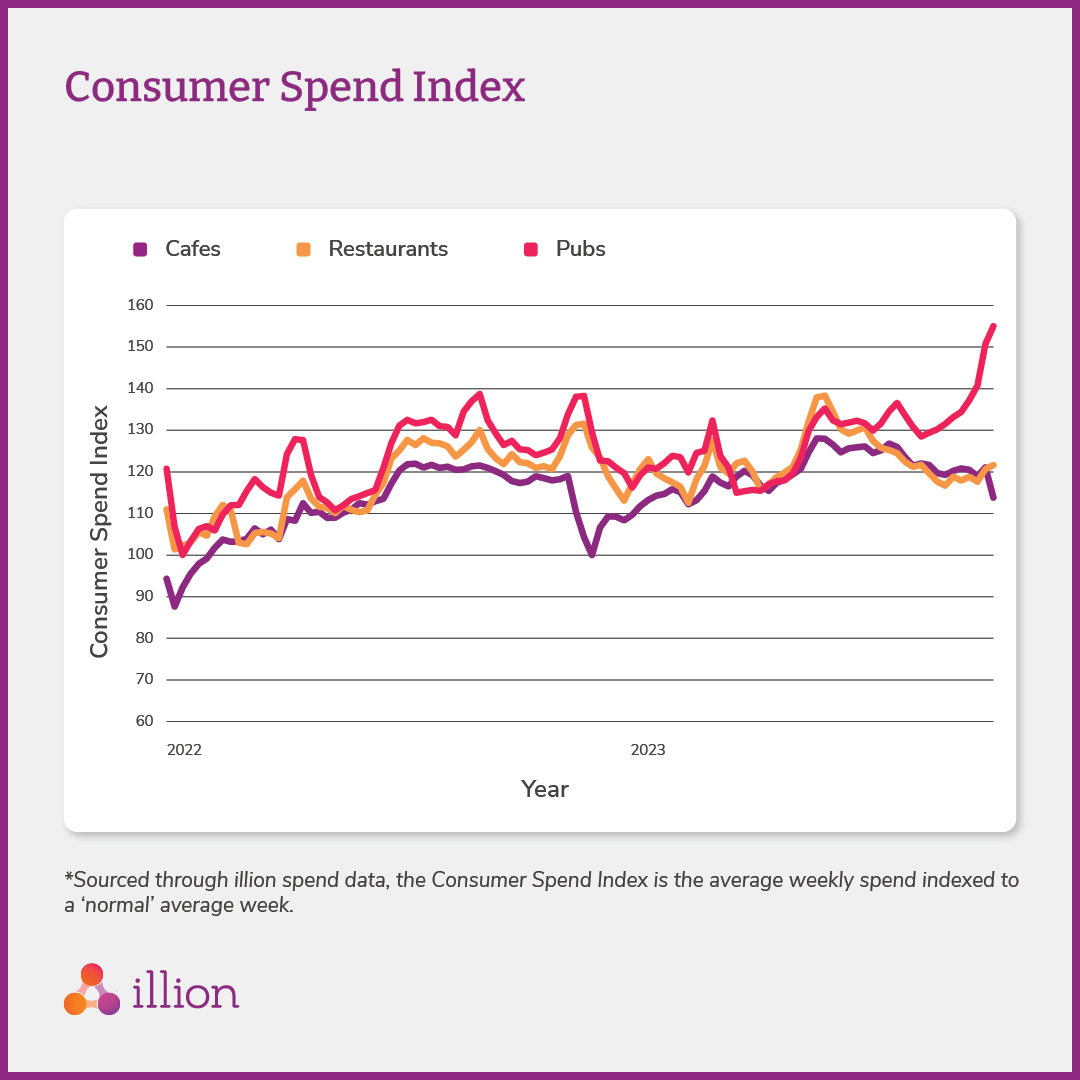

According to recent data observed by the illion trade bureau, cafes and restaurants are now facing increased financial stress, as consumers have been spending less at these establishments in 2024.

This has resulted in a significant rise in the average number of days businesses in this industry are delaying invoice payments to suppliers.

Could these delayed payments have a ripple effect on other business sectors?

Find out what the latest data is showing in our Economic Snapshot below.

Behind the Data: The who, what, where, when and why behind the data

Who: The analysis has been compiled by illion’s Head of Analytics Louis Tsang

What: The analysis and data is sourced from illion’s proprietary trade bureau and illion’s spend data. The trade bureau can show payments between businesses and suppliers and can highlight how late a company is paying another company beyond agreed terms. illion spend data is sourced from transaction data available through our Open Data Solutions product.

Where: The focus is on Australian companies, but similar trends have been observed in New Zealand. illion has the largest commercial trade bureau program in Australia.

When: The food and accommodation sector has been under stress for some time now. illion expects this trend to continue in 2024.

Why: A decrease consumer spending leads to poorer business performance. Trade late payments are a strong indicator of risk and business failures. Businesses tend to fall behind in payments to other businesses and suppliers as they struggle. Monitoring your portfolio using these metrics will give you a heads up on emerging risks.

Want to learn more?

Fill in this form to talk to our friendly team today.