Record inflation figures in 2022 meant that RBA has had to lift cash rates to record levels not seen since before 2014.

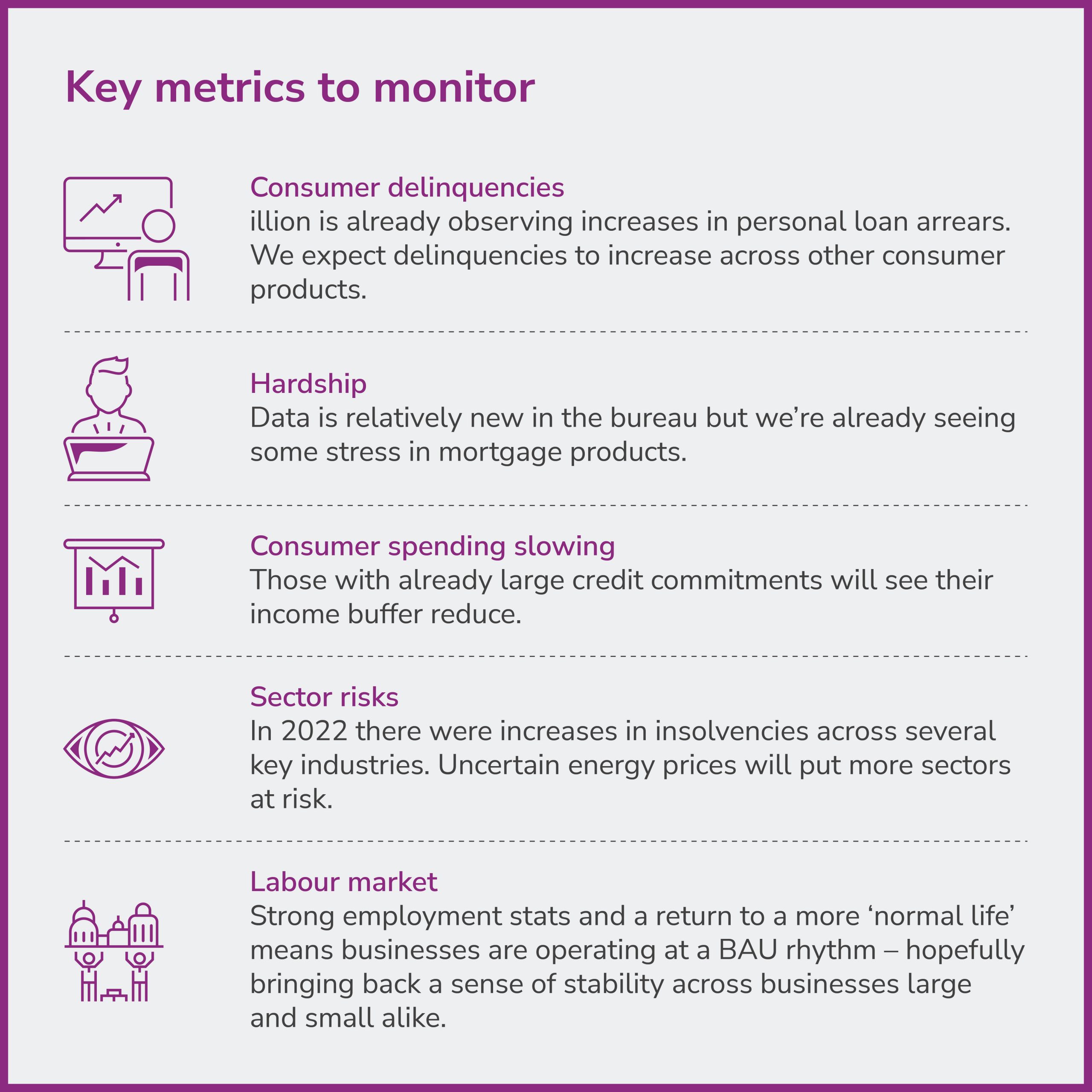

illion data shows stress is starting to materialise, with consumer delinquencies in some unsecured credit products starting to rise. Mortgage delinquencies have yet to materialise, but as the cash rate increases flow through to actual repayment increases (as well as those on fixed-rate loans moving to variable) in 2023, we expect to see an increase in the number of consumers who are struggling.

In 2022, we have seen consumers returning to credit cards, with monthly enquiry volumes over the past 6 months back at pre-2019/2020 levels.

Over the last 12 months, illion has refined its risk scores – our newest version of the illion consumer risk score (iCRS) is now more predictive than ever. It provides average Gini uplifts of 18 points on consumer portfolios. Its effectiveness is largely underpinned by our unique data assets in SACC/MACC lending, the largest coverage of telco data in Australia, and the best scoring algorithms.

While consumers have been spending in 2022, especially enjoying being out and about, we have seen discretionary spending on larger retail items recently tapering off, almost 5-10% lower compared to 6 months ago. We expect this holiday’s usual seasonal spending spree to be more subdued and consumption overall to slow in 2023.

Businesses have been trading well over the past year. Strong labour markets are supporting business output, despite the myriad of challenges – flow-on impacts from rising energy prices, supplier costs going up and general supply chain issues. There has been a substantial uptick in company insolvencies in the last 6 months of 2022, although it is largely driven by a few key stressed industries – construction, manufacturing, and a few services sectors.

Want to learn more?

Fill in this form to talk to our friendly team today.