illion’s Open Banking solutions will unlock a direct path to the data sharing ecosystems that are continually emerging through the Consumer Data Right regime in Australia. Today our solutions relate to income and expenditure transactions, their categorisation and then indicators of credit risk. We have a range of solutions beyond this use case in development and if you would like to know more get in touch (link to form).

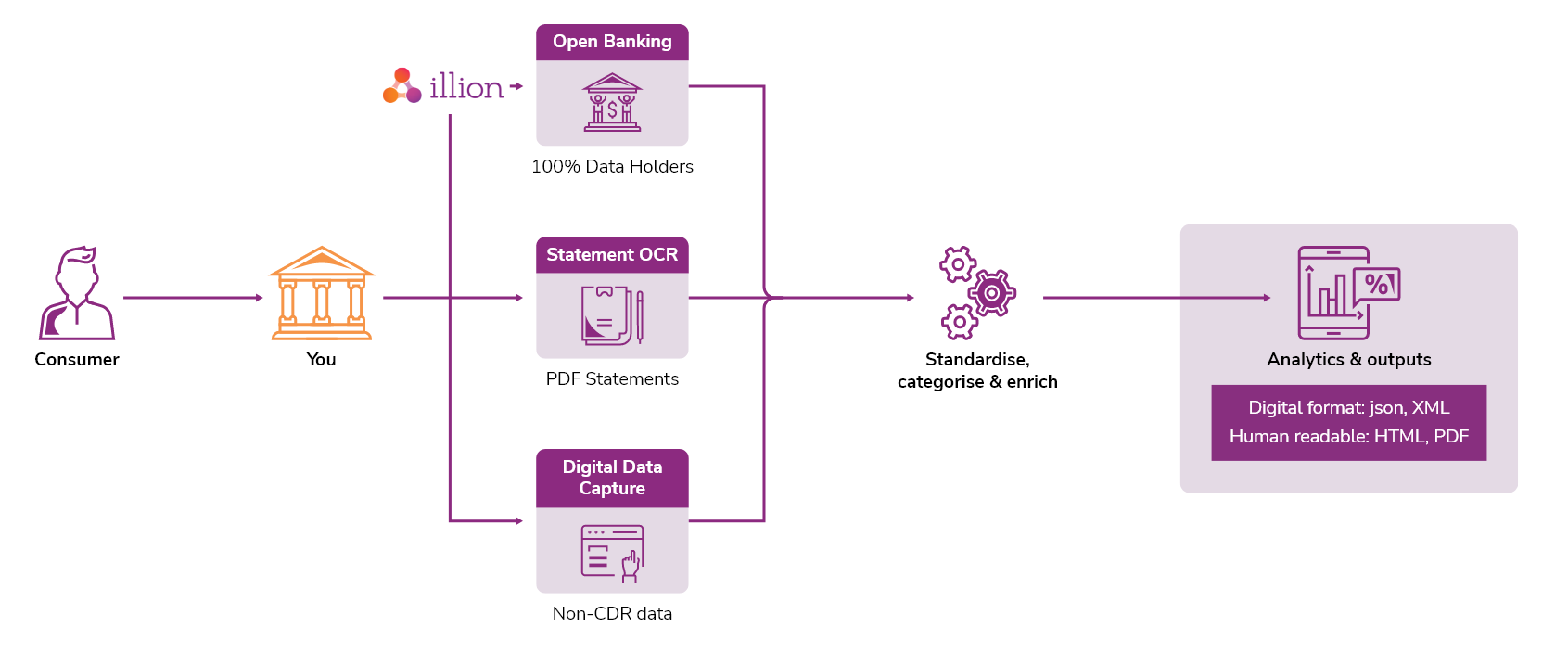

illion is an Accredited Data Recipient within the Consumer Data Right regime. Our clients can can transfer workflows from existing services like BankStatements using OCRStatements, to Open Banking Data feeds. illion can also help customers launch a new BankStatements Open Banking capability through our complete platform. Our integrated, flexible and scalable solutions can enable you to dive into the evolving data-sharing world, streamlining complex operations and empowering both your customers and your business.

Our Open Banking Solution

CDR Accreditation

Work with us to understand your accreditation and access requirements

Data Retrieval

Access information from available financial institutions across Australia and New Zealand

Consumer Dashboards

Provide an easy way for consumers to control consent with a complete hosted solution

Aggregation & Enrichment

Enhance your data feeds with industry leading categorisation and integrate multiple data sources to reveal further insights

Consent Collection

Streamline the consent process with a tailored consent collection system

Ongoing Consent Management

From consent provisioning to maintenance and revocation, we can manage the whole consent lifecycle

Key Benefits

Sophisticated categorisation and decision metrics that deliver intelligent insights.

Access the full range of bank statement sources, including CDR connections and non-CDR solutions in combination.

Fast, flexible and intuitive platforms that provide the data you need, when you need it.

Data security. Each product is rigorously tested and audited by independent, external security experts.

A rich sandbox environment that simulates real banking data, so you can begin developing your solution as soon as possible.

Our customisable and white-labelled solutions can support compliance with CX guidelines and can be configured to flexibly allow for multiple configurations.

How we support you

Brokers

Increase business and improve customer experience by making important decisions within minutes.

Fintechs

Work with experienced providers to build state of the art products using reliable and scalable technology.

Lenders

Encourage a streamlined process confidently, with quick access to detailed, accurate data

Banks

Complete income verification and affordability assessments with unprecedented efficiency

PFM & Wealth Management

Compile data from multiple bank accounts with data aggregation

Other Industries

Gain insights and speed up formerly manual processes with automated systems in other industries such as Real Estate, Property Management, Retail, Insurance, Law.

Products

Data Enrichment & Analytics

Categorise and enrich internally and externally sourced data, to reveal insights for smarter decisions