In the digital economy, a few seconds of delay in detecting a fraud attack can lead to significant financial losses and cause irreparable damage to your brand reputation and customer retention efforts.

greenID Alert can help mitigate this risk.

Derived from millions of identity verifications, this solution can detect fraud at onboarding, so organisations can apply a step-up identity process or reject an application altogether.

greenID Alert leverages unique data across industry sectors including banking, wagering and telecommunications, to detect identity theft in fraud and money laundering, preventing bad actors from entering your business.

Used in conjunction with illion greenID, greenID Alert integrates into your existing identity verification process to help strengthen fraud detection capability.

Highly predictive and accurate fraud alerts

High level of fraud detection with low false-positive rate.

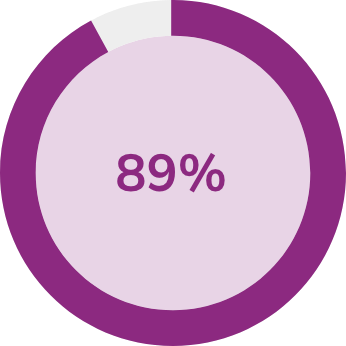

Up to 89% accuracy in detecting identity takeover, money muling and other fraud events

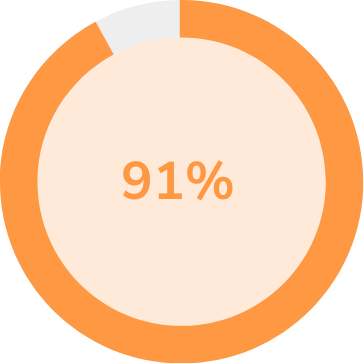

Up to 91% of true-positive alerts had not been picked up by any other detection method or system

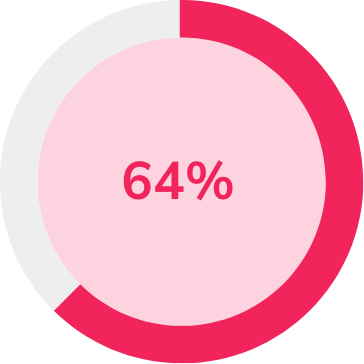

Up to 64% of all identity-related crime has been picked up by greenID Alert*

Detect fraud and suspicious behaviour in real time

Drawn from millions of identity onboarding events – with a machine learning model and expert rules built in Australia for an ANZ market – greenID Alert is highly predictive and can help identify fraud early.

Alerts are generated by detecting fraudulent patterns of use from identity information.

Every suspicious identity verification is tagged with explainable rule code.

Choose to activate and deactivate specific rules for full automation or manual review.

*Data provided by GBG ANZ Pty Limited as at 01/08/2023.