SYDNEY: New data released this week by credit bureau illion, an Experian company, in the December 2024 Australian Consumer Stress Barometer suggests that after three months of hotly anticipated Stage 3 tax cuts, they are working as intended, however the economy is still shaky.

Implemented to offer cost of living relief and support stretched households, money from the tax cuts appears to have gone to paying down consumer debts, rather than increasing discretionary spending – which could have had an inflationary effect.

“illion’s Consumer Credit Stress Barometer for the September quarter showed that, for the first quarter of this financial year, credit stress improved, shoring up the finances of struggling households

Money has gone to the areas consumers need the most, which is great news for most families, and good news for Australia’s fight against inflation. Things could have been different, if debt stayed high and people started spending the money in other ways,” said Barrett Hasseldine, illion’s Head of Modelling.

illion’s September quarter data showed that, overall, Australian householders were more able to control their budgets. This was likely buoyed by wage increases and end-of-financial-year tax refunds, but also by the additional financial support received from stage 3 tax cuts.

However, illion’s data also shows that, although the tax cuts may have helped many average households service their debts, it hasn’t yet had the same impact on high risk and vulnerable groups – those with more debt.

In addition, illion’s data showed that the economy is still weak in places. “Economic stresses are still evident, especially amongst 30-something Mortgage holders,” Barrett added. “The outlook for lower income, mortgage-belt Australia and for the small business sector is still uncertain, and this is a large number of people.”

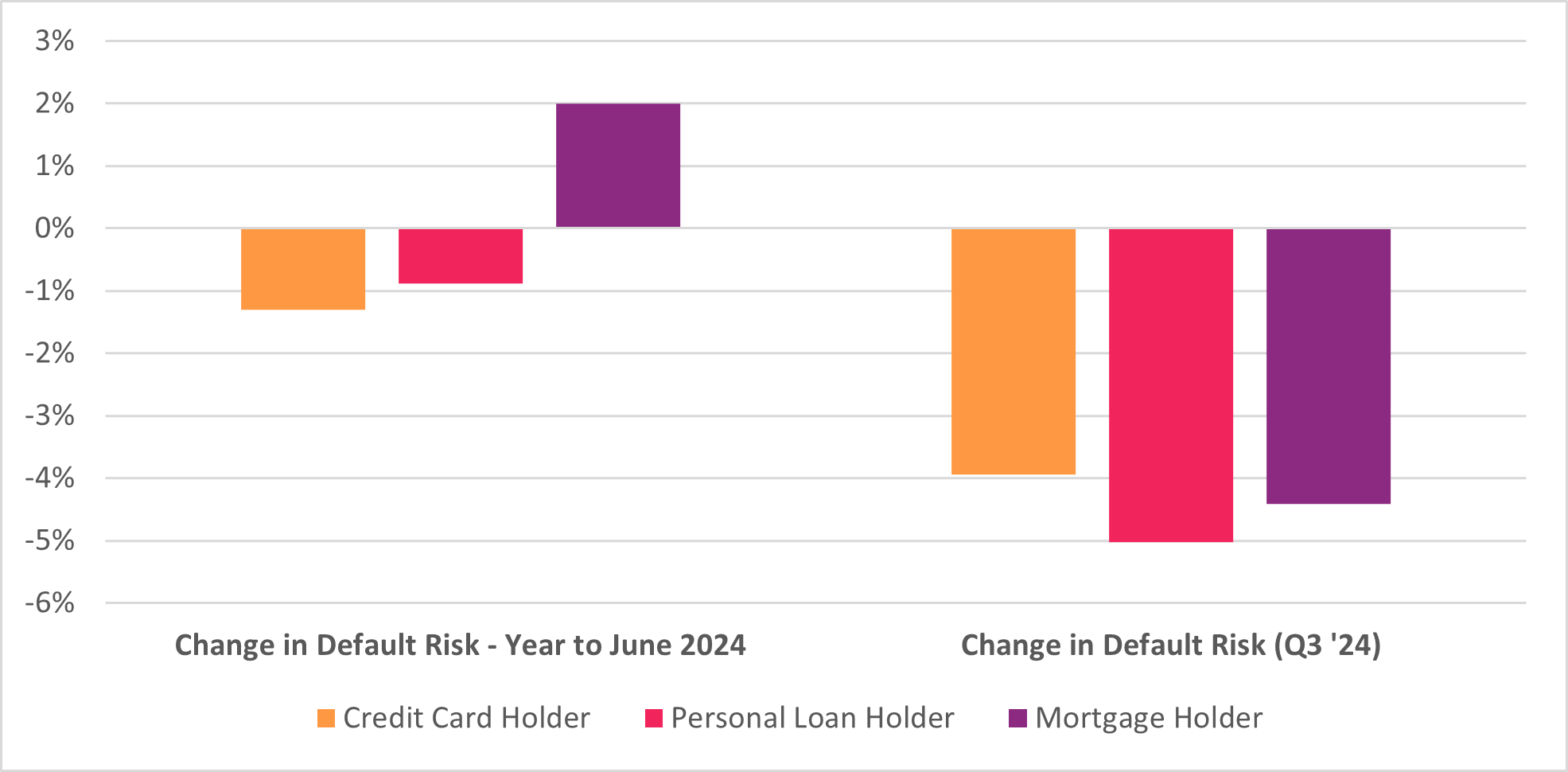

Marked drop in credit risk

illion’s Consumer Credit Stress Barometer shows that in the September quarter, mortgage holder risk fell by 4% – a substantial reverse to the 3% risk deterioration seen in the prior quarter. This has led to an overall improvement of 2% in mortgage holder risk nationally, over the last 15 months.

Percentage Change in Credit Default Risk since June 2023

It also shows that personal loan and cardholder risk have also fallen 5% and 4% (respectively), meaning that Australians have used their improved financial standing to pay down all types of debt.

By state

“The September quarter saw the default risk of mortgage holders falling in all major states,” Barrett added. “In NSW, this improvement reversed the 4% deterioration seen in FY23/24, while in WA, QLD, and SA, it added further to the stability already seen in FY23/24.

“Therefore, while the NSW result suggests some volatility in terms of credit stress, the QLD, WA, and SA results appears to show a sustainable improvement since mid-2023. Victoria saw the largest improvement (6%) in the September quarter, reversing the 4% deterioration seen in FY23/24. However, the overall improvement since June 2023 is still significantly lower when compared to QLD, WA, and SA.”

“Credit demand is down, so this means people aren’t taking on as much debt, which is a mixed blessing. Savings are still falling but at a slower rate, which is another positive sign. However, consumption in retail and of groceries is either flat or falling so this is a bad sign for the economy, but does also mean the economy is not overheating, or as we know it, inflating.”

illion’s Consumer Stress Barometer also pointed to consumer confidence falling again, meaning that the ‘sugar hit’ from end-of-financial-year tax refunds, tax cuts, and recent wage rises may be already wearing off.

“The bottom line is that household budgets either appear to be fully stretched or geared to saving and/or paying down debt rather than consuming. This next quarter will be very telling, given it’s the Christmas quarter and that means traditionally more spending” Barrett added.

By prioritising personal finances, Australia’s lower consumption may have consequences for economic growth into 2025 and may point to why consumer confidence is falling, even though there is a moderate improvement in credit stress.

“Tax cuts were introduced to help households manage their finances but also ‘keep a lid’ on consumption and inflation’ and, so far, our data points to this being what is happening,” added Barrett.

Conversely a lack of discretionary spending may further exacerbate the risk of an economic downturn. The personal finances of Australians remain fragile although cautious steps are being taken in the right direction.

-ENDS-

About illion

illion, an Experian company, is a leading provider of data and analytics products and services in Australia and New Zealand. illion is now owned by Experian, one of the world’s leading global data and technology companies.

About Experian

Experian is a global data and technology company, powering opportunities for people and businesses around the world. We help to redefine lending practices, uncover and prevent fraud, simplify healthcare, deliver digital marketing solutions, and gain deeper insights into the automotive market, all using our unique combination of data, analytics and software. We also assist millions of people to realise their financial goals and help them to save time and money.

We operate across a range of markets, from financial services to healthcare, automotive, agribusiness, insurance, and many more industry segments.

We invest in talented people and new advanced technologies to unlock the power of data and innovate. As a FTSE 100 Index company listed on the London Stock Exchange (EXPN), we have a team of 22,500 people across 32 countries. Our corporate headquarters are in Dublin, Ireland. Learn more at experianplc.com.

Back to Media Releases or visit our LinkedIn page for more updates.

Want to learn more?

Fill in this form to talk to our friendly team today.