The illion Transaction Risk Score (iTRS) assesses an applicant’s bank transaction data to provide a fresh and unique insight into their financial behaviour.

This solution is the most significant enhancement to data-driven risk management since the introduction of Comprehensive Credit Reporting.

Both lenders and consumers can stand to profit through better credit underwriting, more effective loan pricing and more tailored lending terms and conditions.

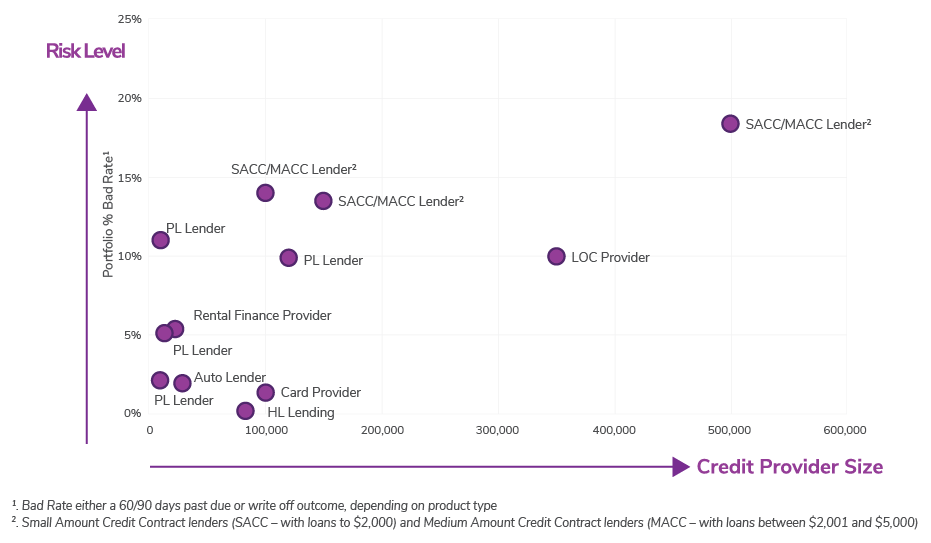

iTRS is proven across different segments of the market

Across different products and risk appetites, iTRS has proven to be valuable to both high-volume, higher-risk SACC/MACC lenders as well as traditional Tier 1 credit card and home loan providers.

The benefits of using the iTRS extend beyond just subprime lenders.

The iTRS is enabling a range of credit providers across Australasia to better mitigate risk, optimise their processes, and boost profits.

With automatic decisioning, the iTRS has helped high-risk lenders to reduce bad debts, and lower-risk lenders to increase approval rates.

A fast way to make smart credit decisions

According to our research, customers who have combined iTRS with existing credit assessment methods have been able to:

Increase profitability

iTRS can identify risks in customers that were previously undetected, while also identifying customers who are a safe credit risk but have little traditional credit information available. The combination of these factors enables lenders to increase profitability.

Improve customer experience

iTRS delivers highly reliable consumer insights, so you can optimise your pricing and provide customers a faster time to ‘yes’.

Want to learn more?

Fill in this form to talk to our friendly team today.