Behind the Data: The who, what, where, when, and why behind the data

Who: The analysis is compiled by illion Head of Analytics Louis Tsang, and the illion Analytics team.

What: This analysis and data is sourced from illion’s extensive data assets:

Commercial bureau – The trade bureau can show payments between businesses and suppliers and can highlight how late a company is paying another company beyond agreed terms. Along with other commercial information on Australian and New Zealand companies, illion has some of the industry’s best performing risk scores and indexes.

Consumer bureau – This bureau utilises accounts opening and accounts repayment history information from Comprehensive Credit Reporting data.

Spend analytics database – illion has access to a wide range of consumer spend data. Through this data we can observe high-level spend patterns and changes throughout periods.

Where: The focus of the report is across both Australia and New Zealand, across consumer and commercial domains.

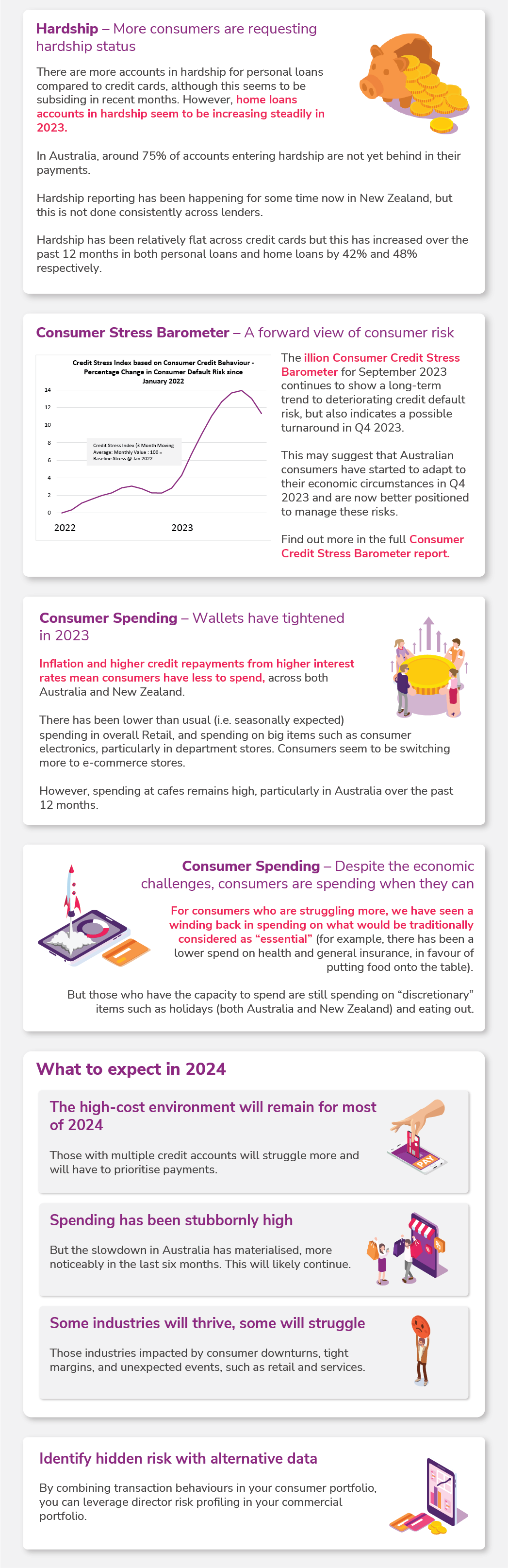

When: In 2023, we have seen deterioration in key metrics such as consumer delinquencies and commercial late payments. However, the trend is not broad across all sectors and segments. Some industries and lending products have been performing well, better than historical benchmarks.

Why: Monitoring all the risk metrics available at the illion bureau is vital to identifying hidden risk and will help you manage your portfolios in the most effective way possible.

Want to learn more?

Fill in this form to talk to our friendly team today.